Disscover

how we we revolutionize loan management

Our platform allows you to get the full-service offerings of a doctors office from the comfort of your home.

- Lead Module

- Loan Origination Module

- Loan Management Module

- User Management Module

- Credit Rating

- Dealer / Distributor Module

- Loan Recovery Module

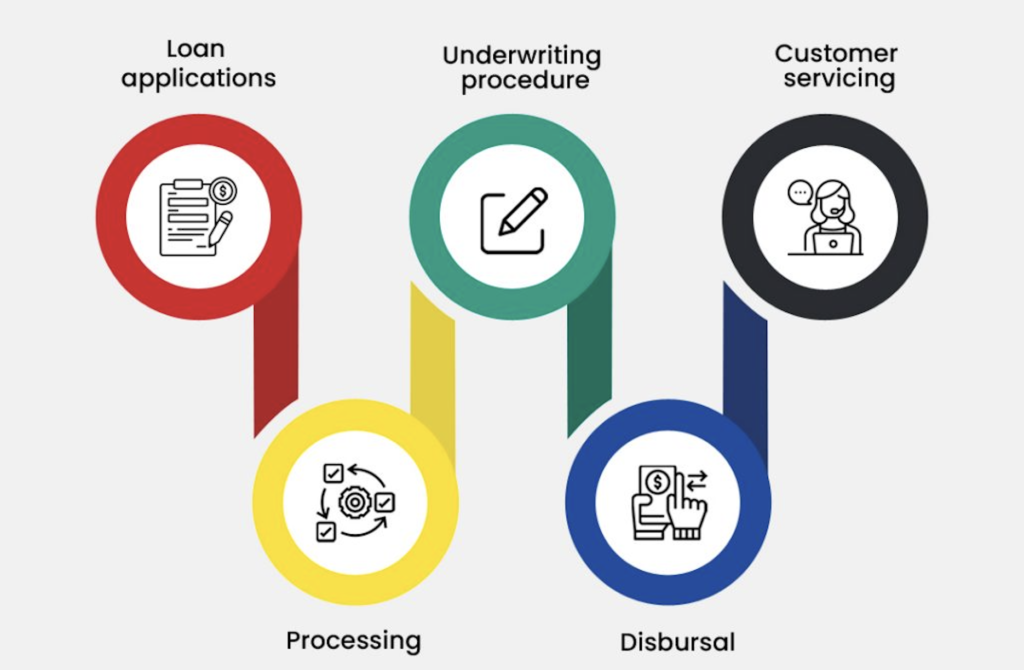

Unlocking the future of digital loans

How does it work?

Pre Qualifier - KYC

Users can get on-boarded with full KYC details by users or institutions.

Apply for Loan

Loan products will be seen and can be applied with categories.

Credit Score and Disbursal

Enlarged credit score with parameters setup and rule engine.

Loan management

Entire Loan Management with EMI, Schedule. Recovery and More.

We work with BFIs

Banks

Banks providing diverse loans for businesses, homes, and education.

Finance Companies

Specialized organizations offering loans with flexible terms and rates.

Hire Purchase

Installment-based financing for purchasing assets like vehicles, electronics etc.

Welfare funds

Funds offering low-interest loans for employees' financial and emergency needs.

Why Choose Our Solution?

With a focus on innovation and customer satisfaction, we aim to help financial institutions thrive in an increasingly competitive market.

- Efficiency

- Transparency

- Scalibility

- Analytics

we’re here to all your questions

Our platform has been instrumental for the new trends of Loan Automation.

Q1: Is your system customizable for different institutions?

Yes, our system is fully customizable to meet your specific operational and regulatory needs.

Q2: How secure is the platform?

We use industry-standard encryption and security protocols to ensure data protection.

Q3: Can your system handle high transaction volumes?

Absolutely. Our platform is designed for scalability, making it ideal for institutions of all sizes.