The financial technology (fintech) industry has witnessed remarkable growth and innovation in recent years, driven by advancements in digitalization, automation, and data analytics. Amidst this transformation, the architecture of fintech platforms plays a crucial role in determining their scalability, flexibility, and resilience. One architectural paradigm that has gained prominence is microservices architecture. In this technical blog, we delve into the utilization of microservices in building fintech platforms and explore the myriad advantages they offer.

Understanding Microservices Architecture

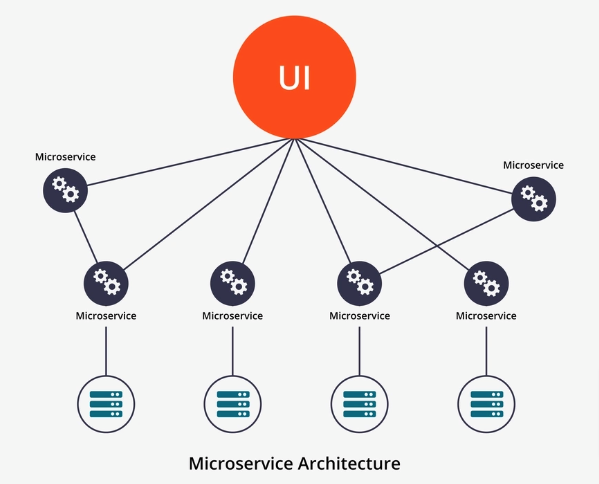

Microservices architecture is an architectural style that structures an application as a collection of small, loosely coupled services. Each service is designed to perform a specific business function and can be developed, deployed, and scaled independently. Communication between services typically occurs through lightweight protocols such as HTTP or messaging queues, facilitating modularity and flexibility.

"Microservices architecture emphasizes the decomposition of an application into small, independent services, promoting modularity, flexibility, and scalability."

Key Components of Microservices Architecture:

- Service: A service encapsulates a specific business capability or function, such as payment processing, customer management, or risk assessment. Each service is self-contained and can be developed and deployed independently.

- API Gateway: An API gateway serves as a single entry point for clients to interact with the microservices architecture. It handles requests from clients, routes them to the appropriate services, and aggregates responses. Additionally, the API gateway can perform tasks such as authentication, authorization, and rate limiting.

- Service Registry: A service registry is a centralized repository that maintains the location and metadata of all services within the architecture. It enables services to discover and communicate with each other dynamically, facilitating the scalability and resilience of the system.

- Load Balancer: Load balancers distribute incoming network traffic across multiple instances of a service to optimize resource utilization and ensure high availability and reliability.

- Containerization and Orchestration: Microservices are often deployed within containers, lightweight and portable runtime environments that encapsulate dependencies and configurations. Container orchestration platforms such as Kubernetes automate the deployment, scaling, and management of containerized microservices, simplifying operations at scale.

Utilizing Microservices in Fintech Platforms

- Fintech platforms encompass a wide range of functionalities, including payments processing, lending, investment management, compliance, and risk assessment. The adoption of microservices architecture in fintech enables organizations to address the following challenges effectively:

- Scalability: Fintech platforms experience varying levels of demand, particularly during peak transaction periods. Microservices architecture facilitates horizontal scalability, allowing organizations to scale individual services independently based on workload requirements. By dynamically provisioning additional instances of services in response to increased demand, fintech platforms can maintain responsiveness and reliability, ensuring uninterrupted service delivery.

- Modularity and Agility: Fintech organizations operate in a dynamic and rapidly evolving landscape, necessitating agility and adaptability in software development. Microservices architecture promotes modularity by breaking down complex systems into smaller, manageable components. Each microservice can be developed, tested, and deployed independently, enabling teams to iterate and release new features rapidly. This modularity accelerates the development lifecycle, enhances flexibility, and facilitates continuous integration and delivery (CI/CD) practices.

- Fault Isolation and Resilience: In traditional monolithic architectures, a failure in one component can propagate throughout the entire system, resulting in system-wide outages. Microservices architecture mitigates this risk by isolating failures to individual services. If a service experiences an issue or becomes unresponsive, it does not affect the operation of other services within the architecture. Additionally, microservices can employ resilience patterns such as circuit breakers, retries, and fallback mechanisms to gracefully handle failures and degrade functionality without compromising the overall system.

- Technology Diversity and Innovation: Fintech platforms leverage a diverse array of technologies, frameworks, and programming languages to address specific business requirements and use cases. Microservices architecture accommodates this diversity by allowing each service to be implemented using the most suitable technology stack. Teams can select programming languages, databases, and frameworks that align with the requirements of individual services, enabling innovation and experimentation. Furthermore, microservices architecture fosters a culture of innovation by decoupling services and promoting autonomy among development teams, empowering them to explore emerging technologies and implement novel solutions.

- Compliance and Security: Fintech organizations operate in a highly regulated environment, subject to stringent compliance requirements and security standards. Microservices architecture facilitates compliance by enabling organizations to implement granular access controls, data encryption, and audit logging at the service level. Each microservice can enforce security measures tailored to its specific functionality, reducing the attack surface and enhancing overall security posture. Furthermore, microservices architecture supports the principle of least privilege, ensuring that only authorized services have access to sensitive data and resources.

Conclusion

Microservices architecture has emerged as a transformative paradigm for building scalable, resilient, and agile fintech platforms. By decomposing complex systems into smaller, loosely coupled services, organizations can achieve greater scalability, modularity, and innovation. The adoption of microservices enables fintech companies to respond rapidly to changing market dynamics, deliver superior customer experiences, and maintain compliance with regulatory requirements. However, implementing microservices architecture requires careful planning, architectural design, and operational considerations. Organizations must address challenges related to service discovery, communication, monitoring, and governance to realize the full benefits of microservices in fintech. Despite these challenges, the advantages offered by microservices architecture make it a compelling choice for fintech organizations seeking to thrive in an increasingly competitive and dynamic landscape.